A Quote by Robert Kiyosaki

I don't save money. Save is a four letter word! I like to borrow money because I can get richer faster on borrowed money. I have what is called retained earnings, so I don't have to save money. If I need money, I will go out and borrow it.

Related Quotes

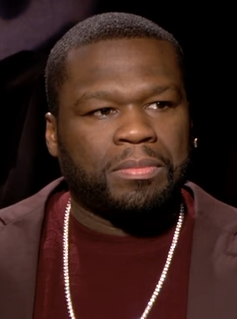

You know, money will never save anyone. Compassion can save someone, love can save someone, money will never save anyone. And as long as the entire society will put money first... Money should be like third or fourth or fifth, I'm not saying lets get rid of money, but how can we put money as number one? As the only value, like if you are rich, you're famous you go VIP, why? It's just insane, the way we've transformed the society.

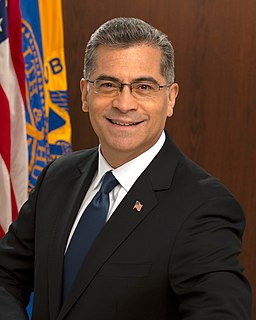

If we finally chose as a country to take responsibility for the wars that we believe we must engage in, and rather than borrow money to exercise that authority to go to war, we actually pay for these wars, that would save us over a trillion dollars, because that's what we have spent in Iraq and Afghanistan - all through borrowed money.

Everybody's got money for vacation time. Look at how much we all spend just to get - well, I get sick on the loop-the-loop roller coasters. People pay money for that kind of experience. So I would certainly save up money, save several vacations worth of money, to go on a suborbital flight or any rocket flights.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

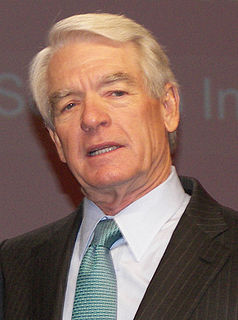

When I was 14, I did all kinds of different odd jobs. I had a chicken farm, had an ice cream operation in the summertime, worked as a caddy; all things to make money and save money. Save money in order to invest - that was the first step, though I never really accumulated very much because of other demands like bicycles and things like that.

Once money goes into a charity, it is tax exempt, so that's a benefit you get. And in return, you have to use the assets of the charity to serve the public good. So if Trump is using this money basically to save his businesses, the money isn't helping people. That's a violation of the letter and the spirit of law.

Learn how to cook! That's the way to save money. You don't save it buying hamburger helpers, and prepared foods; you save it by buying fresh foods in season or in large supply, when they are cheapest and usually best, and you prepare them from scratch at home. Why pay for someone else's work, when if you know how to do it, you can save all that money for yourself?