A Quote by Robert Kiyosaki

Every time the Fed implements 'quantitative easing,' a.k.a. printing more money, two things go up: taxes and inflation. When taxes and inflation go up, more jobs are lost.

Quote Topics

Related Quotes

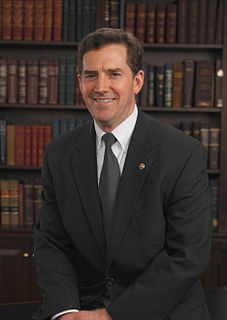

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

In the North, neither greenbacks, taxes, nor war bonds were enough to finance the war. So a national banking system was created to convert government bonds into fiat money, and the people lost over half of their monetary assets to the hidden tax of inflation. In the South, printing presses accomplished the same effect, and the monetary loss was total.

I came into politics partly because I want to be able to reduce taxes so that individuals have more of their money to spend, so that businesses have more of their money to create jobs, but I believe that lower taxes are sustainable when you get the public finances in order, so I will only make promises I can keep on taxation.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.