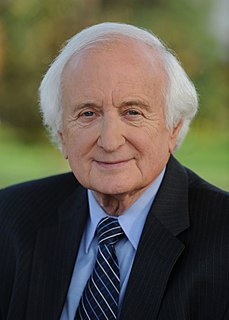

A Quote by Robert Kiyosaki

People clinging to job security, savings, retirement plans, and other relics will be the ones financially-ravaged from 2010-2020, the most volatile world-changing decade in history.

Related Quotes

The postwar [WWII] GI Bill of Rights - and the enthusiastic response to it on the part of America's veterans - signaled the shift to the knowledge society. Future historians may consider it the most important event of the twentieth century. We are clearly in the midst of this transformation; indeed, if history is any guide, it will not be completed until 2010 or 2020. But already it has changed the political, economic and moral landscape of the world.

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

The other thing that really I regretted not being able to do was to push effectively for the reform of the Security Council. Because the world was changing, and is changing very fast, and I felt the UN was holding on to old arrangements. Most governments felt that it has such a narrow power base, based on the results of the second world war.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.