A Quote by Robert Kiyosaki

The Nasdaq bubble and crash were followed by the real estate bubble then subprime crash, which led to the unprecedented printing of trillions of dollars in an attempt to prevent a global depression.

Related Quotes

From the Great Depression, to the stagflation of the seventies, to the current economic crisis caused by the housing bubble, every economic downturn suffered by this country over the past century can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial 'boom' followed by a recession or depression when the Fed-created bubble bursts.

That's our mirror. Every dip, every crash, every bubble that's burst, a testament to our brilliant stupidity. This one gave us the railroads. This one the Internet. This one the slave trade. And if we hope to do anything about saving the environment, or getting to other worlds, we'll need a bubble for that too. Everything I've ever done in my life worth anything has been done in a bubble: in a state of extreme hope and trust and stupidity.

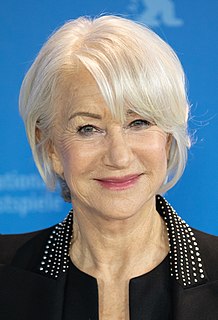

I've not won different awards - many, many times - so luckily I've practiced that whenever you are nominated for anything, you enter into this marvelous, fantabulous bubble called the bubble of nomination. The minute the envelope is opened and your name isn't called out, the bubble bursts. And no one calls you up the next day to say, 'So sorry you didn't win,' or 'You looked gorgeous - nothing. If you win, you get about another 24 hours in that lovely bubble and then - pop - you are slightly wet all over from the bubble and realize that you have to get on with real life.

If the stock market does go through a crisis of confidence, which I think clearly will happen one of these days, no one can predict just like you couldn't the dot com crash or the Lehman crash, but when it goes down it will go down by thousands of points because everyone will panic. No one owns this market today because they believe there's a huge sunny future for the United States economy. They're buying because they think the Fed can keep the thing pumped up, the bubble expanding.

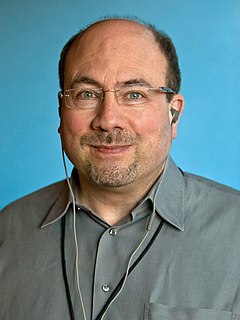

My take on the whole dot-com bubble was that a lot of people who wanted to make a lot of money got too excited and hyped up the commercial aspects of the Internet prematurely. I think the vision of the Internet as a democratizing medium - as everyone's printing press - is real. We got distracted from that by the mass hallucinations of the bubble.

A major boom in real stock prices in the US after Black Tuesday brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.

The enthusiasm for Tesla and other bubble-basket stocks is reminiscent of the March 2000 dot-com bubble. As was the case then, the bulls rejected conventional valuation methods for a handful of stocks that seemingly could only go up. While we don't know exactly when the bubble will pop, it eventually will.