A Quote by Robert Kiyosaki

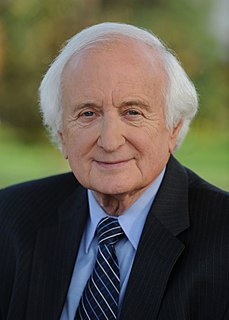

When I was young, many people worked for a company with a pension plan that covered them for as long as they lived. If they didn't have a pension plan, they could count on Social Security and Medicare.

Related Quotes

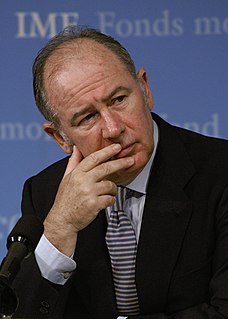

The simple index fund solution has been adopted as a cornerstone of investment strategy for many of the nation's pension plans operated by our giant corporations and state and local governments. Indexing is also the predominant strategy for the largest of them all, the retirement plan for federal government employees, the Federal Thrift Savings Plan (TSP). The plan has been a remarkable success, and now holds some $173 billion of assets for the benefit of our public servants and members of armed services.

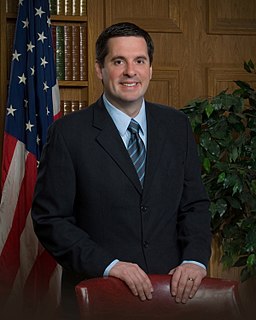

You've worked hard all your life. You've paid Medicare taxes for almost 30 years. But under the Republican plan, Medicare won't be there for you. Instead of Medicare as it exists now, under the Republican plan you'll get a voucher that will pay as little as half your Medicare costs when you turn 65—and as little as a quarter in your 80s. And all so that millionaires and billionaires can have a huge tax cut.

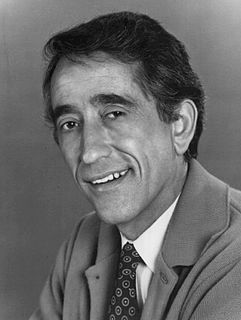

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?