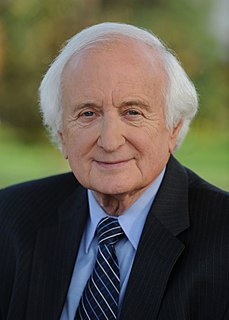

A Quote by Robert Kuttner

If social security depresses savings rates, it is only because it is unfunded.

Related Quotes

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?

For Social Security to be financially sound, the federal government should have $100 trillion - a sum of money six-and-a-half times the size of our entire economy - in the bank and earning interest right now. But it doesn't. And while many believe that Social Security represents our greatest entitlement problem, Medicare is six times larger in terms of unfunded obligations.