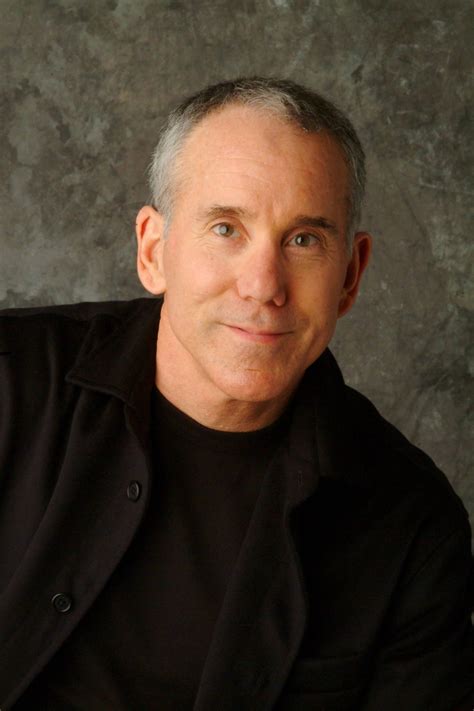

A Quote by Robert Lucas, Jr.

From the beginnings of modern monetary theory, in David Hume's marvelous essays of 1752, 'Of Money and Of Interest,' conclusions about the effect of changes in money have seemed to depend critically on the way in which the change is effected.

Related Quotes

"We hold these truths to be sacred and undeniable" in a draft of the Declaration of Independence changes it instead into an assertion of rationality. The scientific mind of Franklin drew on the scientific determinism of Isaac Newton and the analytic empiricism of David Hume and Gottfried Leibniz. In what became known as "Hume's Fork" the latters' theory distinguished between synthetic truths that describe matters of fact, and analytic truths that are self-evident by virtue of reason and definition.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

When I say the economy is shrinking, it's the economy of the 99%, the people who have to work for a living and depend on earning money for what they can spend. The 1% makes its money basically by lending out their money to the 99%, on charging interest and speculating. So the stock market's doubled, the bond market's gone way up, and the 1% are earning more money than ever before, but the 99% are not. They're having to pay the 1%.

There is one bit of advice given us by the ancient Greeks, and by the Jews in the Old Testament, and by the great Christian teachers of the Middle Ages, which the modern economic system has completely disobeyed. All these people told us not to lend money at interest; and lending money at interest - what we call investment - is the basis of our whole system.

Monetary reform, if it is to be genuine and successful, must sever money and banking from politics. That's why a modern gold standard must have: no central bank; no fixed rations between gold and silver; no bail-outs; no suspension of gold payments or other bank frauds; no monetization of debt; and no inflation of the money supply, all of which have proved so disastrous in the past.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

Great people in the United States have been disenfranchised.I'll give you an example, it has always been the way to do it, to work hard, save your money, put your money in the bank, get interest on your money and retire wealthy, at least modestly wealthy. Well, the people that have done that have been hurt terribly because there is no interest on your money. You get no money. I just signed for some CDs where you are getting a quarter of one percent. A quarter of one percent! They don't even want your money, the banks.