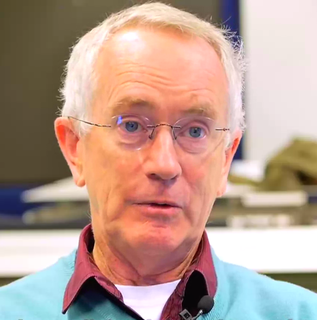

A Quote by Robert Reich

No economy can continue to function when the vast middle class and everybody else don't have enough purchasing power to buy what the economy is capable of producing without going deeper and deeper into debt.

Related Quotes

If you have a sane economy, and by sane economy I mean one which is not addicted to debt, not a Ponzi economy, then the change in debt each year should contribute a minor amount to demand. Therefore, if you tried to correlate debt to the level of unemployment you would not find much of a correlation. Unfortunately that is not the economy we live in.

An underpaid man is a customer reduced in purchasing power. He cannot buy. Business depression is caused by weakened purchasing power. Purchasing power is weakened by uncertainty or insufficiency of income. The cure of business depression is through purchasing power, and the source of purchasing power is wages.

Most people think of the economy as producing goods and services and paying labor to buy what it produces. But a growing part of the economy in every country has been the Finance, Insurance and Real Estate (FIRE) sector, which comprises the rent and interest paid to the economy's balance sheet of assets by debtors and rent payers.

If the Chinese economy can be opened so that currencies are convertible, Chinese tourists can take money and go see the world. Chinese businessmen can go and buy property in the U.S. and France and every place. All of a sudden, it's just going to be a blossoming global economy. I think it's going to be good for everybody.

For the workers and their families, being able to bring home a living wage helps their families and, by extension, helps our economy. Seventy percent of our economy is consumer-based. We know that when lower- and middle-class families have money and disposable income, they spend it. That puts money back into the economy. It's a win-win for everybody: Not just for the individual, not just production at a specific company (like Nissan), but for the greater good.