A Quote by Robert Reich

Government subsidies to elite private universities take the form of tax deductions for people who make charitable contributions to them.

Quote Topics

Related Quotes

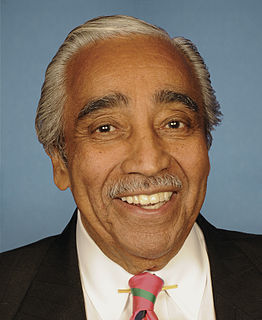

You can use the tax code to make people smoke less. You can use the tax code to make 'em smoke more. You can use the tax code to make 'em buy beer or buy less beer, more booze or less booze. You can screw the tax code around to make 'em make more charitable contributions. You think they're going to get rid of this power? Ain't no way, fool.

If you take all the food aid, America is by far the most generous country. If you take the direct aid, we're very generous. But when you add on our private contributions - see, our tax system encourages private citizens to donate to organisations that, for example, help the folks in Africa. And when you take the combined effort of US taxpayers' money plus US citizens' donations, we're very generous. And we'll do more.

What you're saying is that 'I, the superior elite, will take care of you.' Why? Because, you see, that superior, elite group needs to feel superior and elite. And they can't be superior and elite unless you have a whole lot of people down there groveling around. So you keep them down there by feeding them.

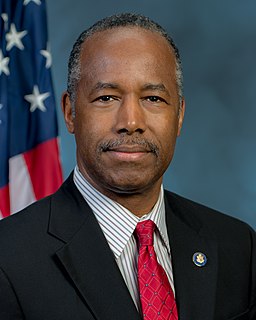

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.