A Quote by Robert W. Hemphill

If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash, or credit. If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless situation is almost incredible - but there it is.

Quote Topics

Absolutely

Absurdity

Almost

Ample

Bank

Banks

Borrow

Cash

Circulation

Coin

Commercial

Commercial Banks

Complete

Could

Create

Credit

Currency

Dependent

Deposit

Dollar

Every

Gets

Grasp

Hopeless

Incredible

Loans

Money

Our

Paid

Permanent

Picture

Prosperous

Situation

Someone

Staggering

Starve

Synthetic

System

Thought

Tragic

Were

Without

Would

Related Quotes

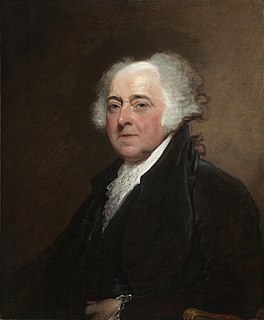

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

At the base of the Fed pyramid, and therefore of the bank system's creation of "money" in the sense of deposits, is the Fed's power to print legal tender money. But the Fed tries its best not to print cash but rather to "print" or create demand deposits, checking deposits, out of thin air, since its demand deposits constitute the reserves on top of which the commercial banks can pyramid a multiple creation of bank deposits, or "checkbook money."

Then came the second Amsterdam discovery, although the principle was known elsewhere. Bank deposits...did not need to be left idly in the bank. They could be lent. The bank then got interest. The borrower then had a deposit that he could spend. But the original deposit still stood to the credit of the original depositor. That too could be spent. Money, spendable money, had been created. Let no one rub his or her eyes. It's still being done-every day. The creation of money by a bank is as simple as this, so simple, I've often said, that the mind is slightly repelled.

Government, possessing the power to create and issue currency and credit as money and enjoying the right to withdraw both currency and credit from circulation by taxation and otherwise, need not and should not borrow capital at interest as a means of financing government work and public enterprises.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

The Koreans that make their money in our community: If we have a Black bank, you'll find they don't deposit anything of what they take from us into a Black bank that would serve our community. They set up a bank in their own community. The Honorable Elijah Muhammad, my Teacher, called people like this "Bloodsuckers of the poor." All they want is to make a dollar, and run.

The problems of 2008 were never cured. The Federal Reserve's solution to the crisis was to lend the economy enough money to borrow its way out of debt. It thought that if it could subsidize banks lending homeowners enough money to buy houses from people who are defaulting, then the bank balance sheets would end up okay.

JPMorgan was already, for the most part. Our businesses at JPMorgan share the same cash-management systems. The commercial bank, the private bank, the retail bank, they all use the branches. The cash-management system moves the money around the world - for global corporations, and for you, the consumer, too.

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.

We are privileged that the dollar is the "currency of last resort" and the most important currency in the world. Global commodities are priced in dollars. Central banks in other countries hold great quantities of dollars. The dollar was the safe harbor, the port in the storm during the credit crisis.

In our election manifesto is: we keep the right to create money and to bring in circulation, for the cause of the government ... Those who do not share this view, reply us to the issue of paper money is for the banks, the government should stay out of the banking business. I agree with Jefferson's opinion ... and just like him I say again: the issue of money is a matter for the government and the banks should stay out of government activity.