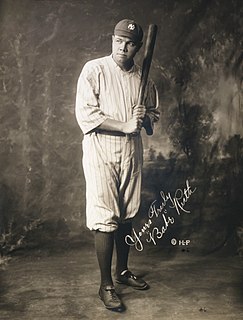

A Quote by Rocky Bridges

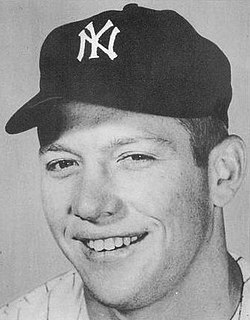

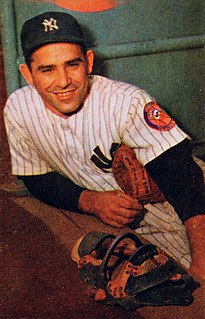

The players are too serious. They don't have any fun any more. They come to camp with a financial adviser and they read the stock market page before the sports pages. They concern themselves with statistics rather than simply playing the game and enjoying it for what it is.

Related Quotes

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

I hate being too serious about anything. If I'm with my friend, I want to be having fun with him or her. And if anybody is reading my story, I want them to be not only reading the story, but I want them to feel they're having fun; that they're enjoying it. So any way you can make it more informal, more fun-filled, more amusing - instead of just a dry story that goes on and on - if there's any way to do that, I like to try and do it.

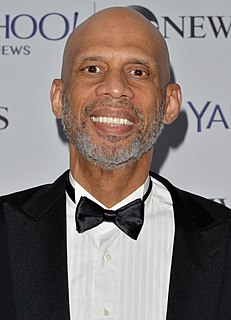

The NBA is the strongest professional sports league in the world. The league and the game is bigger than any one person, Michael Jordan included, and they always will be. I hope that today players, especially our young players, continue to recognize that simple fact. Nothing is more important than the game itself and the fans who support it.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

I think that what's happening is that girls are enjoying playing. It's a lot more acceptable, and now we have a Women's Super League with hugely dedicated female role models - really committed players who people can see are dedicated and training as hard if not harder than any male players - that's all progressing the sport.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

I think what happened in the last 10 or 15 years in the art market is that all the players - and that includes artists, dealers, art advisors, everyone - basically became dealers. We've had old-school collectors morph into speculators, flipping works. We've seen auction houses buying works directly from artists or from sleazy middlemen. The last step before the crash was the artists themselves supplying the auction houses. Dealing themselves, you know? The art world is as unregulated as any financial market there is.