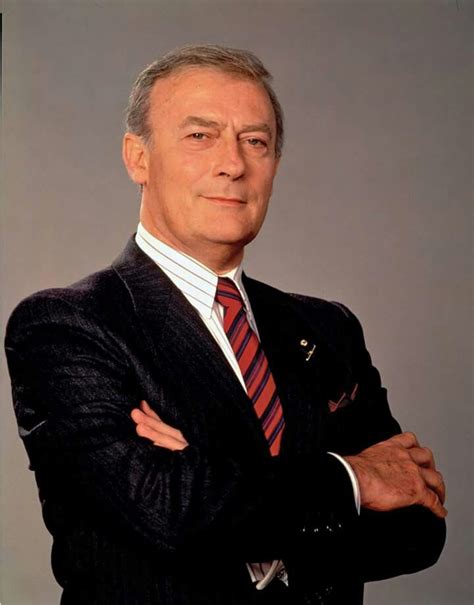

A Quote by Rocky Wirtz

I understand that fans think short-term, and there's nothing wrong with that. You live or you die in the short term. But I believe in our system, and when you do that, you don't make knee-jerk decisions.

Quote Topics

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

With my eyes closed, I ask if she knows how this will all turn out. "Long-term or short-term?" she asks. Both. "Long-term," she says, "we're all going to die. Then our bodies will rot. No surprise there. Short-term, we're going to live happily ever after." Really? "Really," she says. "So don't sweat it.

Any strategy that involves crossing a valley accepting short-term losses to reach a higher hill in the distance will soon be brought to a halt by the demands of a system that celebrates short-term gains and tolerates stagnation, but condemns anything else as failure. In short, a world where big stuff can never get done.

Outsourcing, in and of itself, isn't responsible for the erosion of America's high tech infrastructure. The short-term thinking that led to a lot of bad outsourcing decisions is the root cause. And short-term thinking isn't a problem confined to the executive suite. It's a problem in Washington and in our society as a whole.