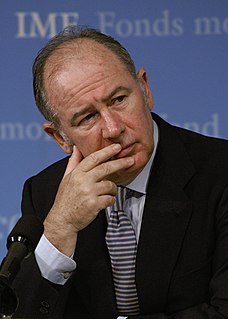

A Quote by Rodrigo Rato

We have seen a strong increase in oil prices and up to this year we see that the world has been able to absorb that.

Related Quotes

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

It's estimated that about 30 percent of the increase in grain prices could be attributed to the decision to embrace biofuels, particularly corn-based ethanol. It has done nothing for climate change and the business is in real trouble now with the collapse of oil prices. It's completely dependent on a dollar subsidy and tariff from the government.

I've been saying for a long time, and I think you'll agree, because I said it to you once, had we taken the oil - and we should have taken the oil - ISIS would not have been able to form either, because the oil was their primary source of income. And now they have the oil all over the place, including the oil - a lot of the oil in Libya, which was another one of her disasters.

Gas prices in many parts of the country are nearing $4 a gallon; it could get even worse as unrest spreads throughout the oil-exporting Middle East. Yet the Obama administration once again seems to see no crisis. It has curtailed new leases for offshore oil exploration for seven years and exempted thousands of acres in the West from new drilling. It will not reconsider opening up small areas of Alaska with known large oil reserves.