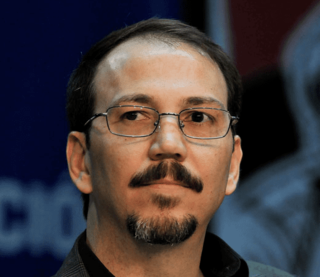

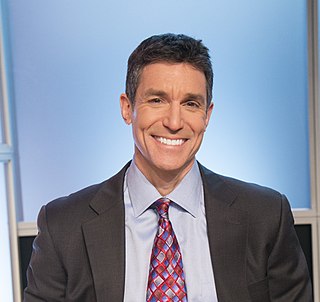

A Quote by Roger Altman

The United States is much further along because its financial crisis struck three years before Europe's, in 2008, causing headwinds that have pressured it ever since.

Related Quotes

The division of the United States into federations of equal force was decided long before the Civil War by the high financial powers of Europe. These bankers were afraid that the United States, if they remained in one block and as one nation, would attain economic and financial independence, which would upset their financial domination over the world. The voice of the Rothschilds prevailed... Therefore they sent their emissaries into the field to exploit the question of slavery and to open an abyss between the two sections of the Union.

What the U.S. does is it continues to print money when the economic situation gets difficult. This is what happened in the last depression during the summer of 2008 when they tried to resolve the economic crisis by printing valueless money. This is the business privilege given to them at the famous conference of Bretton Woods in 1944 when the United States emerged as the superpower after Europe and the rest of the world, mainly Europe, that had collapsed because of the war.

It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud. The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident.

I believe the number is 70% of the world's refugees since World War II have been taken in by the United States. Every year, year in, year out, the United States admits more legal immigrants than the rest of the world combined. The United States has granted amnesty before to three million illegals and appears prepared to do it again.

Although this crisis in some ways started in the United States, it is a global crisis. We bear a substantial share of the responsibility for what has happened, but factors that made the crisis so acute and so difficult to contain lie in a broader set of global forces that built up in the years before the start of our current troubles.

Let's stop for a second and remember where we were eight years ago [in 2008]. We had the worst financial crisis, the Great Recession, the worst since the 1930s. That was in large part because of tax policies that slashed taxes on the wealthy, failed to invest in the middle class, took their eyes off of Wall Street, and created a perfect storm.