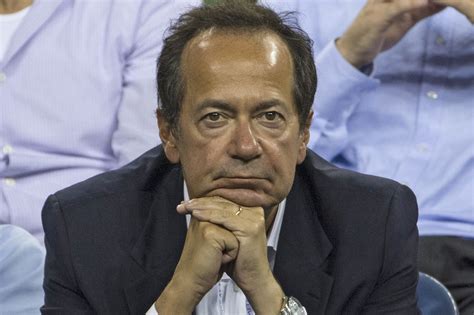

A Quote by Roger Altman

If a lending institution is faced with bids for a package of toxic assets that are less than the carrying value of those assets, the sale of those assets would trigger a further loss and reduce the underlying capital of the institution.

Related Quotes

If God was the owner, I was the manager. I needed to adopt a steward's mentality toward the assets He had entrusted - not given - to me. A steward manages assets for the owner's benefit. The steward carries no sense of entitlement to the assets he manages. It's his job to find out what the owner wants done with his assets, then carry out his will.

It always seemed, and still seems, ridiculously simple to say that if one can acquire a diversified group of common stocks at a price less than the applicable net current assets alone - after deducting all prior claims, and counting as zero the fixed and other assets - the results should be quite satisfactory.