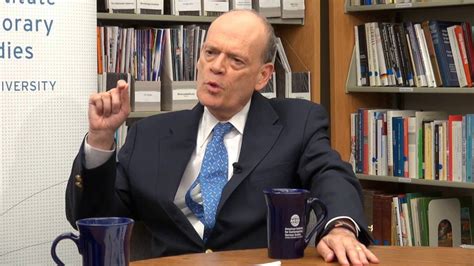

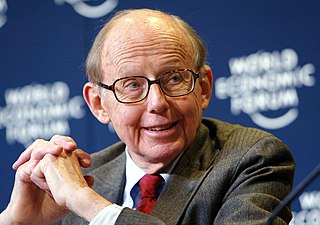

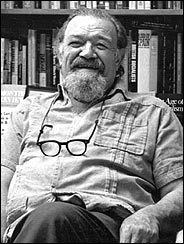

A Quote by Ron Chernow

There is no country in the world where it's as easy to find venture capital in the stock market as the United States.

Related Quotes

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

In the Islamic world, the U.S. is seen in two quite different ways. One view recognizes what an extraordinary country the U.S. is.The other view is of the official United States, the United States of armies and interventions. The United States that in 1953 overthrew the nationalist government of Mossadegh in Iran and brought back the shah. The United States that has been involved first in the Gulf War and then in the tremendously damaging sanctions against Iraqi civilians. The United States that is the supporter of Israel against the Palestinians.

I think in theory, the United States finds it much easier to deal with situations where there is a leading country. You can go to the leaders of that country and say, for example, to India, "There are all these problems in Bangladesh, we really have to do something about it, what do you suggest we can do to work out a common policy?" But when you don't have the equivalent of India, you have to go capital to capital trying to put together a coalition, which is extraordinarily difficult, especially in the Arab world, because of the historic rivalries and branches of Islam.

The United States presents a value system to the world that is based on democracy, based on economic freedom, based on individual rights for men and women, .. I think that is what makes us such a draw for nations around the world. People come to the United States to be educated, to become Americans. We are a country of countries and we touch every country, and every country in world touches us.

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.