A Quote by Ron Chernow

One of the very nice things about investing in the stock market is that you learn about all different aspects of the economy. It's your window into a very large world.

Related Quotes

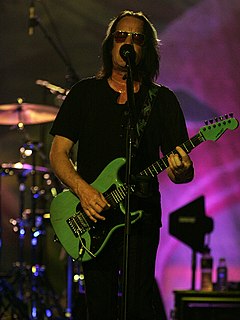

My very first records, I was very interested in how you get the particular quality you want out of it, and I began to learn about the engineering and aspects of production and things very early on. I got hands-on with the process and taught myself how to engineer, as opposed to just being a producer who asked the engineer to make it sound nice.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

I think we are evolving rapidly into one world culture. It's certainly one world economy. With billions of people online, I think we'll appreciate the wisdom in many different traditions as we learn more about them. People were very isolated and didn't know anything about other religions 100 years ago.

One respect in which I'm very much my father's son is how I feel about Joyce. 'Ulysses' is very much about daily life, when you get into this other guy's life and you learn about the things he cares about, and why he cares about them. And then, very indirectly, very subtly, you learn why politics has impacted his life, too.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.