A Quote by Ron Chernow

What I find very interesting about the mutual funds managers is that here are people who are the new masters of the universe. They're managing billions, yet they're subject to this quiet daily tyranny of numbers.

Related Quotes

Our capitalistic scheme in the latter years of the 20th century seems to have lost its way. We've had a "pathalogical change" from traditional owners capitalism where most of the rewards have gone to those who make the investments and assume the risks to a new and deeply flawed system of managers capitalism where the managers of our corporations our investment system, and our mutual funds are simply take too large a share of the returns generated by our corporations and mutual funds leaving the last line investors - pension beneficiaries and mutual fund owners at the bottom of the food chain.

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.

The fund scandals shined the spotlight on the fact that mutual fund managers were putting their interests ahead of the fund shareholders who trusted them, which had much more substantial consequences in the form of excessive fees and the promotion - as the market moved into the stratosphere - of technology funds and new economy funds which were soon to collapse.

Throughout the universe of public and private funds, managers are measured quarterly against one index or another, defined by statistics, and corralled into this category or that category so that fund of funds, pensions, and other institutions can make comforting - if not necessarily prudent - asset allocation decisions.

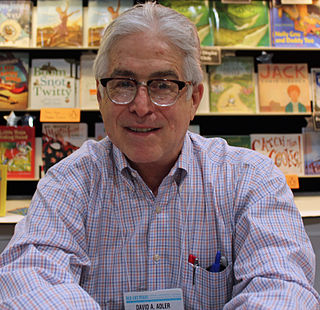

I write about people I think are interesting, and then I discuss it with my editor, and she decides if she thinks it will be interesting to children as well. If I have no great interest in the subject, I find the work to be terribly boring. And if I find the person interesting, I love the research part and, by extension, the writing as well.

I never said it. Honest. Oh, I said there are maybe 100 billion galaxies and 10 billion trillion stars. It's hard to talk about the Cosmos without using big numbers. I said "billion" many times on the Cosmos television series, which was seen by a great many people. But I never said "billions and billions." For one thing, it's too imprecise. How many billions are "billions and billions"? A few billion? Twenty billion? A hundred billion? "Billions and billions" is pretty vague. When we reconfigured and updated the series, I checked-and sure enough, I never said it.

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.