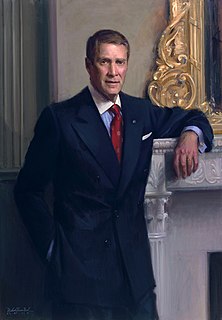

A Quote by Ron Lewis

Though Congress continues to explore possible solutions to ensure social security solvency, everyone must take personal responsibility to prepare their own retirement savings accordingly.

Related Quotes

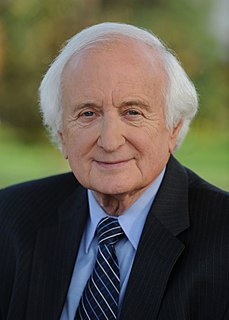

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?