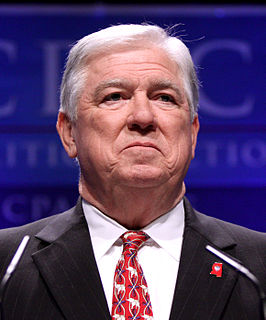

A Quote by Ron Paul

We in the Congress have a moral and constitutional obligation to protect the value of the dollar and to understand why it is so important to the economy that a central bank not be given the unbelievable power of inflating a currency at will and pretending that it knows how to fine-tune an economy through this counterfeit system of money.

Related Quotes

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.

The lesson for Asia is; if you have a central bank, have a floating exchange rate; if you want to have a fixed exchange rate, abolish your central bank and adopt a currency board instead. Either extreme; a fixed exchange rate through a currency board, but no central bank, or a central bank plus truly floating exchange rates; either of those is a tenable arrangement. But a pegged exchange rate with a central bank is a recipe for trouble.

If government manages to establish paper tickets or bank credit as money, as equivalent to gold grams or ounces, then the government, as dominant money-supplier, becomes free to create money costlessly and at will. As a result, this 'inflation' of the money supply destroys the value of the dollar or pound, drives up prices, cripples economic calculation, and hobbles and seriously damages the workings of the market economy.

We can tell the general public that the gold and foreign currency reserves of the Central Bank are not designed to finance the economy, but rather to ensure foreign trade turnover. Therefore, we need this level to be able to provide the necessary foreign trade turnover for such an economy as Russia's for a period of at least three months.

If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash, or credit. If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless situation is almost incredible - but there it is.

Most Americans are more concerned about the economy and job creation. And they can't understand why the Obama administration or the Democrat majority in Congress wants to pass a bill like the cap-and-trade tax that will cost us jobs, that will hurt our economy, that will drive up costs for families, as well as for small businesses.

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.

There is no reason products and services could not be swapped directly by consumers and producers through a system of direct exchange – essentially a massive barter economy. All it requires is some commonly used unit of account and adequate computing power to make sure all transactions could be settled immediately. People would pay each other electronically, without the payment being routed through anything that we would currently recognize as a bank. Central banks in their present form would no longer exist – nor would money.

Today it's fashionable to talk about the New Economy, or the Information Economy, or the Knowledge Economy. But when I think about the imperatives of this market, I view today's economy as the Value Economy. Adding value has become more than just a sound business principle; it is both the common denominator and the competitive edge.