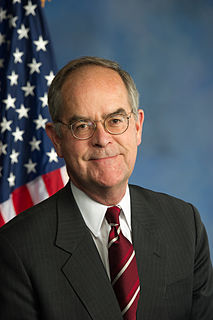

A Quote by Ron Paul

The Federal Reserve and Congress have systematically taught the American people to trust the government and that caution in spending is harmful to the economy.

Related Quotes

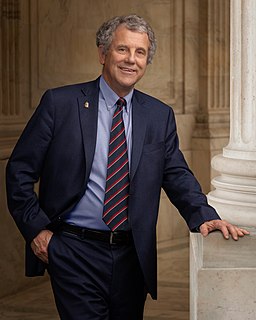

If the Federal Reserve pursues a policy which Congress or the President believes not to be in the public interest, there is nothing Congress can do to reverse the policy. Nor is there anything the people can do. Such bastions of unaccountable power are undemocratic. The Federal Reserve System must be reformed, so that it is answerable to the elected representatives of the people.

Everybody complains about pork, but members of Congress keep spending because voters do not throw them out of office for doing so. The rotten system in Congress will change only when the American people change their beliefs about the proper role of government in our society. Too many members of Congress believe they can solve all economic problems, cure all social ills, and bring about worldwide peace and prosperity simply by creating new federal programs. We must reject unlimited government and reassert the constitutional rule of law if we hope to halt the spending orgy.

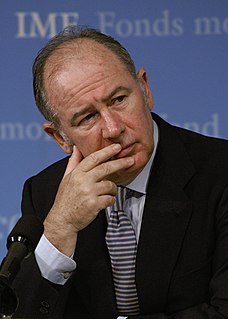

In a democracy the responsibility for the Government's economic policies, which so affect the economy, normally rests with the elected representative of the people: in our case, with the President and the Congress. If these two follow economic policies inimical to the general welfare, they are accountable to the people for their actions on election day. With Federal Reserve independence, however, a body of men exist who control one of the most powerful levers moving the economy and who are responsible to no one.

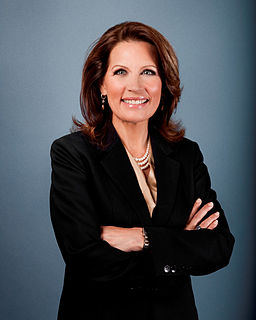

Government is taking 40 percent of the GDP. And that's at the state, local and federal level. President Obama has taken government spending at the federal level from 20 percent to 25 percent. Look, at some point, you cease being a free economy, and you become a government economy. And we've got to stop that.

The greatest threat facing America today

is the disastrous fiscal policies of our own government,

marked by shameless deficit spending and

Federal Reserve currency devaluation.

It is this one-two punch -

Congress spending more than it can tax or borrow,

and the Fed printing money to make up the difference -

that threatens to impoverish us by further

destroying the value of our dollars.

It may seem strange, but Congress has never developed a set of goals for guiding Federal Reserve policy. In founding the System, Congress spoke about the country's need for "an elastic currency." Since then, Congress has passed the Full Employment Act, declaring its general intention to promote "maximum employment, production, and purchasing power." But it has never directly counseled the Federal Reserve.