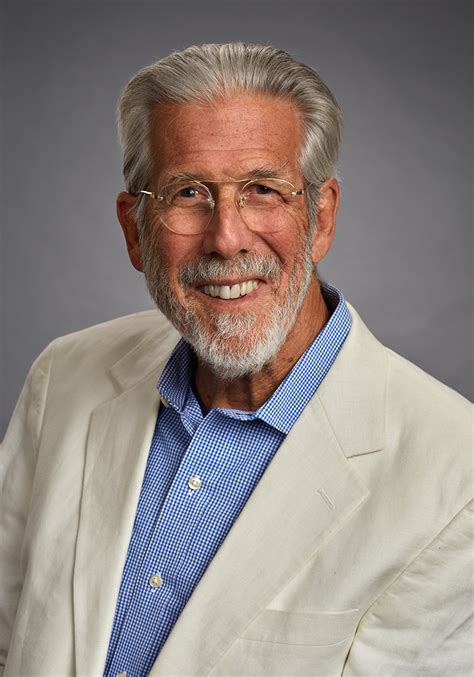

A Quote by Ron Paul

When people become frightened, they look for things of real value. They will go to monetary metals, gold and silver, and they will buy other things, such as buying property. But no matter what we have, whether we have our gold coins or we have our property, if we have an authoritarian government, that is our greatest threat. So, I would like to think that there is no perfect protection, other than shrinking the size and scope and power of government, so that we can be left alone and take care of ourselves.

Quote Topics

Alone

Authoritarian

Authoritarian Government

Become

Buy

Buying

Care

Coins

Frightened

Go

Gold

Gold And Silver

Gold Coins

Government

Greatest

Greatest Threat

Left

Left Alone

Like

Look

Matter

Metals

Monetary

No Matter What

Other

Our

Ourselves

People

Perfect

Power

Property

Protection

Real

Real Value

Scope

Shrinking

Silver

Size

Take

Take Care

Than

Things

Think

Threat

Value

Whether

Will

Would

Related Quotes

The lesson that Americans today have forgotten or never learned - the lesson which our ancestors tried so hard to teach - is that the greatest threat to our lives, liberty, property, and security is not some foreign government, as our rulers so often tell us. The greatest threat to our freedom and well-being lies with our own government!.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

Back in 1960, the paper dollar and the silver dollar both were the same value. They circulated next to each other. Today? The paper dollar has lost 95% of its value, while the silver dollar is worth $34, and produced a 2-3 times rise in real value. Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.

The threat of gold redeemability imposes a constant check and limit on inflationary issues of government paper. If the government can remove the threat, it can expand and inflate without cease. And so it begins to emit propaganda, trying to persuade the public not to use gold coins in their daily lives.

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.

All of the government's monetary, economic and political power, as well as its extensive propaganda machinery, will be enlisted in a constant battle to drive down the price of gold - but in the absence of any fundamental change in the nation's monetary, fiscal, and economic direction, simply regard any major retreat in the price of gold as an unexpected buying opportunity.

If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content.

In all the thrashing about that results from our dwindling gold reserves, it's about time that this country and other countries get some perspective on the situation. The day this country is out of the stuff, that day gold becomes what it's worth as a metal and no longer will have much significance as a monetary measurement. It isn't the gold we have that makes this nation rich. It's what we make, our knowhow, our productivity. So long as this country produces more and better, the world will continue to want what we make.

I'm not in favor of no government. You do need a government. But by doing so many things that the government has no business doing, it cannot do those things which it alone can do well. There's no other institution in my opinion that can provide us with protection of our life and liberty. However, the government performs that basic function poorly today, precisely because it is devoting too much of its efforts and spending too much of our income on things which are harmful. So I have no doubt that that's the major single problem we face.

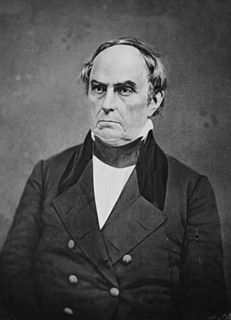

We are bound to maintain public liberty, and, by the example of our own systems, to convince the world that order and law, religion and morality, the rights of conscience, the rights of persons, and the rights of property, may all be preserved and secured, in the most perfect manner, by a government entirely and purely elective. If we fail in this, our disaster will be significant, and will furnish an argument, stronger than has yet been found, in support of those opinions which maintain that government can rest safely on nothing but power and coercion.

The effect of the corporation, under the prevailing policy of the free, go-as-you-please method of organization and management, has been to drive the bulk of our people, other than farmers, out of property ownership; and, if allowed to go on as present, it will keep them out... The paramount problem is not how to stop the growth of property, and the building up of wealth, but how to manage it so that every species of property, like a healthy growing tree will spread its roots deeply and widely in the soil of a popular proprietorship.

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.