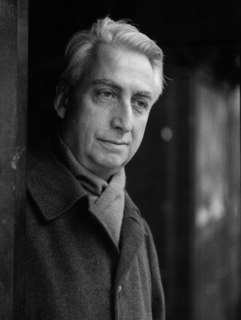

A Quote by Ron Williams

When I was a CEO, I thought I understood private equity. I didn't. And what I've learned since my retirement, and since becoming directly involved in the world of private equity, points the way to a new career path for thousands of talented senior executives - and a new engine for value creation.

Related Quotes

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

Nobody in my generation ever started out in private equity. We got there by accident. There was no private equity business - actually, the word didn't even exist - when I started. I got there out of the purest of happenstance and so I think many people find what they really enjoy doing just in that way. So another piece of advice for you is: don't worry too much about what you're going to be doing when you get out of business school - life will come your way.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.