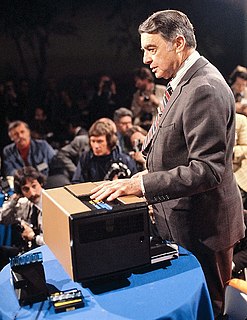

A Quote by Ronald Reagan

Our federal tax system is, in short, utterly impossible, utterly unjust and completely counterproductive . . . [It] reeks with injustice, and is fundamentally un-American

Related Quotes

Aladdin in his most intoxicated moments would never have dreamed of asking his [djinn] for [a polaroid] ... It's utterly new in concept and appearance, utilizing an utterly revolutionary flash system, an utterly revolutionary viewing system, utterly revolutionary electronics, and utterly revolutionary film structure.

It is impossible to manage the health care requirements of tens of millions of American citizens at the federal level. It is impossible to manage all of the permutations of people's economic aspirations and lives through a complex tax code. It is impossible to try to second-guess the market. It is impossible, from a managerial standpoint, for the federal government to do the things it is trying to do today.

There is a profound injustice at the heart of the American economy. You look at the media and realize that these corporate-run commercial entities are failing to give Americans the information they need to make informed choices. You look at the food we're eating and the obesity epidemic and realize there is something fundamentally wrong about our nutritional habits. So across the board there is something fundamentally unjust about every aspect of our personal lives.

We also need to encourage Americans to become more fiscally responsible themselves. We can do this by redesigning our tax system into an expenditure tax with a single flat rate. ... We have to substantially reduce the size and scope of the federal government, fundamentally increase the role of the states in choosing their own practices, and bring decision-making closer to the people, not to unelected administrators. These steps are crucial to getting our nation on a path of fiscal, political and constitutional responsibility.

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.

When we fall utterly, something gathers us up. But our falling must be without reservation, without expectation, without hope, though not hopeless. You cant plan that kind of falling. When you abandon yourself utterly to life, the river will flow, and the log jam will free. Impossible is another word for grace. Who wouldve thought it, life takes another turn, and you are gathered up into a whole different way of seeing and being.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.