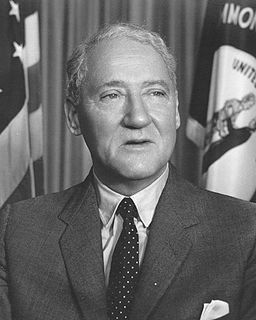

A Quote by Ronald Reagan

Seventy-five years ago I was born in Tampico, Illinois, in a little flat above the bank building. We didn't have any other contact with the bank than that.

Related Quotes

Seventy-five years. That's how much time you get if you're lucky. Seventy-five years. Seventy-five winters, seventy-five springtimes, seventy-five summers, and seventy-five autumns. When you look at it like that, it's not a lot of time, is it? Don't waste them. Get your head out of the rat race and forget about the superficial things that pre-occupy your existence and get back to what's important now.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

I want to work in a bank, definitely. Hopefully, my acting career will go well. But if it doesn't, I go to a bank. If it does, then even at the age of 40, I will still go to a bank, but I have to work in a bank, because I'm really fond of taxation and accounts and investments and all of that. So I will do it. At some point, I will, yes.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."