A Quote by Ronald Ross

Wall Street's favorite scam is pretending that luck is skill.

Quote Topics

Related Quotes

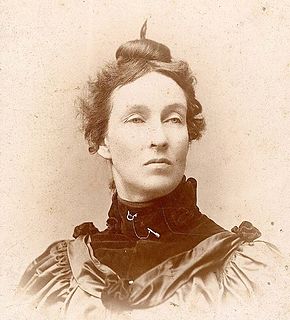

Wall Street owns the country. It is no longer a government of the people, for the people and by the people, but a government for Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master…Let the bloodhounds of money who have dogged us thus far beware.

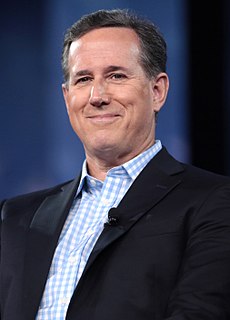

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

You're all Buddhas, pretending not to be. You're all the Christ, pretending not to be. You're all Atman, pretending not to be. You're all love, pretending not to be. You're all one, pretending not to be. You're all Gurus, pretending not to be. You're all God, pretending not to be. When you're ready to stop pretending, then you're ready to just be the real you. That's your home.

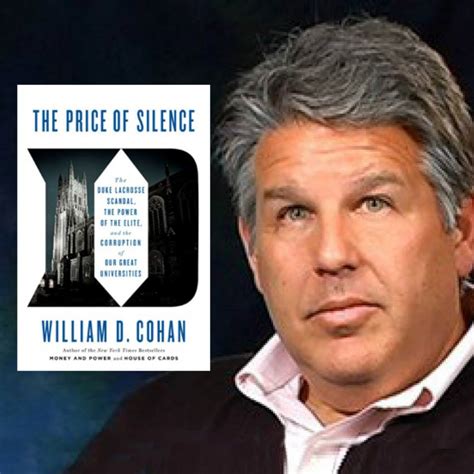

The dirty little secret of what used to be known as Wall Street securities firms-Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns-was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty-four hours away from a funding crisis. The key to day-to-day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.