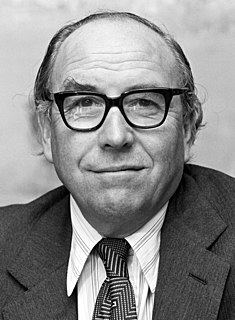

A Quote by Roy Jenkins

Inheritance Tax; - it is, broadly speaking; a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue

Related Quotes

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

We are the heirs of the ages; but the estate is entailed, as large estates frequently are, so that while we inherit the earth, the great round world which is God's footstool, we have only the use of it while we live and must pass it on to those come after us. We hold the property in trust and have no right to injure it or to lessen its value. To do so is dishonest, stealing from our heirs their inheritance.

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

Hardly a man in the world has an opinion upon morals, politics or religion which he got otherwise than through his associations and sympathies. Broadly speaking, there are none but corn-pone opinions. And broadly speaking, Corn-Pone stands for Self-Approval. Self-approval is acquired mainly from the approval of other people. The result is Conformity.