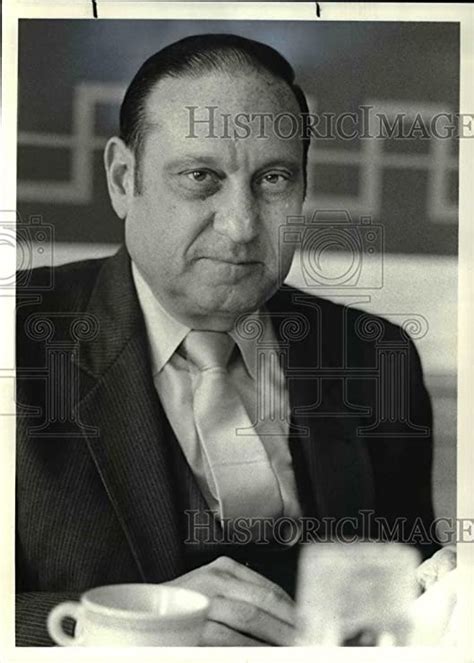

A Quote by Ruben Blades

In those days the big U.S. labels didn't have any particular interest in the Latin market.

Related Quotes

I get kind of, um, bored by all the sexuality and gender labels because I feel like that's where the problem comes in, when people feel that they need to have these particular identities. If you didn't have these labels, and you just acted on how you genuinely felt at any point, then you wouldn't have anything to contend with.

Jack, my 16 year old, was in knots a couple of months back, studying for Latin. I said, "Mate, you've got no interest in Latin. You don't want to go into it after, so drop it." He said, "No, I can't. I'm going to get bullied at school because all my mates are in there." There's a prime example of why no one cooks at school. You're studying Latin, you've got no interest.

The Middle East would always be an important trading partner in just a market sense, like America is a big market for us, Asia is a big market, Europe is a big market. You are going to have hundreds of millions of consumers there, from just a standard market point of view, from a very narrow American point of view.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

The Open Market Committee, as presently established, is plainly not in the public interest. This committee must be operated by purely public servants, representatives of the people as a whole and not any single interest group. The Open Market Committee should be abolished, and its powers transferred to the Federal Reserve Board - the present public members of the committee, with reasonably short terms of office.

Don't think about what the market's going to do; you have absolutely no control over that. Think about what you're going to do if it gets there. In particular, you should spend no time at all thinking about those rosy scenarios in which the market goes your way, since in those situations, there's nothing more for you to do. Focus instead on those things you want least to happen and on what your response will be.