A Quote by Rudy Giuliani

The largest tax reduction in American history, one page tax form, reducing government spending. Those are all the keys to economic progress.

Related Quotes

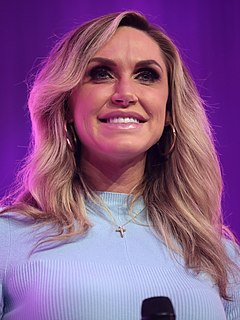

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

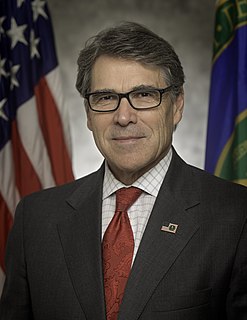

Canada, the United States and Mexico, we developed these energy reserves that we have in this North American region. And you can see a not only driving down the cost of electricity but a major manufacturing boom in this country. Couple that with tax policy, reduction, reducing the corporate tax rate, and that I think a renaissance in manufacturing like we've never seen in this country and really drive the economy.

Sometimes, tax rate increases create the very problems that the spending is intended to cure. In other words, the tax rate increases reduce economic growth; they shrink the pie; they cause more poverty, more despair, more unemployment, which are all things government is trying to alleviate with spending.

Conservatives in general, and even so called Tea Party conservatives, are not against transportation spending. Indeed, interstate commerce is one purpose of interstate highways and byways, and is one of the things the federal government is actually supposed to spend our tax dollars on. What conservatives are opposed to is needless and excessive spending, pork-barrel spending, deficit spending, spending to pick winners and losers among American individuals and corporations, and spending to promote the social and economic whims of the Washington few.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.