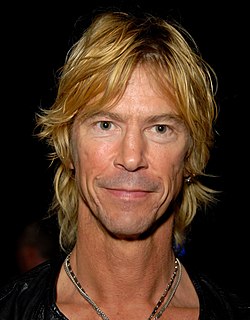

A Quote by Rudy Giuliani

I don't invest in the stock market. I did it a long, long time ago when I was really young, and I got involved in all the investigations and all the prosecutions, and I felt it was better if I didn't make individual investments. So I'm invested in funds, but not in individual - not in individual stocks.

Related Quotes

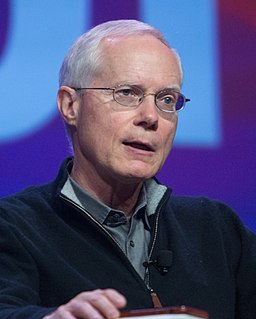

If the investor doesn't have enough time and skill to investigate individual stocks or enough money to diversify a portfolio, the right thing to do is to invest in exchange-traded funds that give you exposure to asset classes. It does make sense for the individual investor to think in terms of holding individual asset classes.

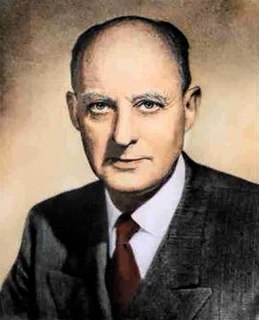

we have complaints that institutional dominance of the stock market has put 'the small investor at a disadvantage because he can't compete with the trust companies' huge resources, etc. The facts are quite the opposite. It may be that the institutions are better equipped than the individual to speculate in the market.But I am convinced that an individual investor with sound principles, and soundly advised, can do distinctly better over the long pull than large institutions.

Freedom is necessary for two reasons. It's necessary for the individual, because the individual, no matter how good the society is, every individual has hopes, fears, ambitions, creative urges, that transcend the purposes of his society. Therefore we have a long history of freedom, where people try to extricate themselves from tyranny for the sake of art, for the sake of science, for the sake of religion, for the sake of the conscience of the individual - this freedom is necessary for the individual.

The most common mistakes were investing in money market funds by people who were so scared at the prospect of managing their own funds that they picked the most conservative option, and their investments did not keep up with inflation. The second major mistake was being too heavily invested in their own company's stock, and buying when it was high and there was a lot of optimism about the company, and then having to sell it low when the company got in trouble.

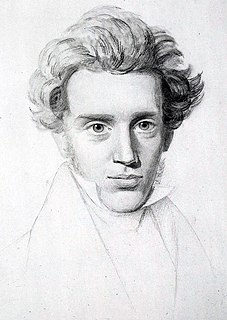

Faith is precisely the paradox that the single individual as the single individual is higher than the universal, is justified before it, not as inferior to it but superior - yet in such a way, please note, that it is the single individual who, after being subordinate as the single individual to the universal, now by means of the universal becomes the single individual who as the single individual is superior, that the single individual as the single individual stands in an absolute relation to the absolute.

Don't make the body fit into the clothes. It really is, it's really respecting an individual and trying to cater to that individual's needs. And I guess that's what really is important for each one of us, dealing with each other in society, is look at the person in front of you, look at the individual in front of you and treat that person as a unique individual being. And I think we get along better, not just fashion-wise, but in terms of just dealing with people day-to-day.

in race relations, the single gesture and the single individual are more often than not doomed to failure. Only the group and the long-term, undeviating policy make much headway. ... if you want to make the world a better place, the first thing you must accept is the fact that you cannot transcend your limitations as an individual.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.