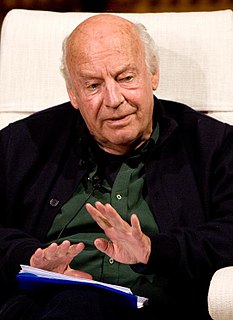

A Quote by Russ Roberts

The incredible stability in inflation is really a novel human experience. And the inflation is being the result of money.

Quote Topics

Related Quotes

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

I think democracies are prone to inflation because politicians will naturally spend [excessively] - they have the power to print money and will use money to get votes. If you look at inflation under the Roman Empire, with absolute rulers, they had much greater inflation, so we don't set the record. It happens over the long-term under any form of government.

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output... A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.