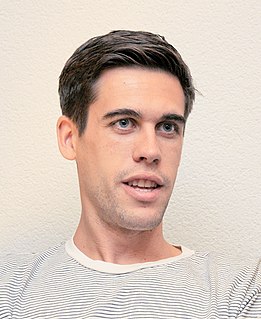

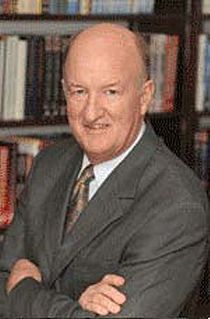

A Quote by Ryan Holiday

Dollar for dollar there is no better investment in the world than a book

Related Quotes

The value of a dollar is to buy just things; a dollar goes on increasing in value with all the genius and all the virtue of the world. A dollar in a university is worth more than a dollar in a jail; in a temperate, schooled, law-abiding community than in some sink of crime, where dice, knives, and arsenic are in constant play.

The risk of an investment is described by both the probability and the potential amount of loss. The risk of an investment-the probability of an adverse outcome-is partly inherent in its very nature. A dollar spent on biotechnology research is a riskier investment than a dollar used to purchase utility equipment. The former has both a greater probability of loss and a greater percentage of the investment at stake.

I am concerned about the erraticness of the dollar. The dollar is up, the dollar is down. We print a lot of dollars. The dollar gets devalued. That is really the concern. If people think the gold price up and down is a reflection of something wrong with gold, no - I say it is something wrong with the dollar.

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

The powershift began already several years ago, under the Bush administration, when the dollar became very volatile and started declining. That is when China shifted from having almost 100 percent of its reserves in dollars to 75 percent. Some countries went completely out of the dollar. The dollar, for all intents and purposes, lost its special reserve status and people starting talking about a portfolio, or basket, approach as a store of wealth instead of the dollar.

No one has yet convinced me a dollar stranded overseas is better than a dollar brought back home here to America for any reasons. So, if a company needs it, whether it's to do research, buy another business in America, grow jobs or try to become more financially strong, that is good for the United States.

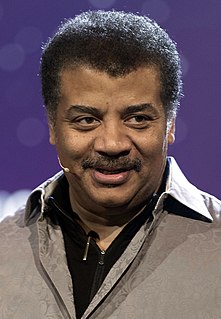

'As a fraction of your tax dollar today, what is the total cost of all spaceborne telescopes, planetary probes, the rovers on Mars, the International Space Station, the space shuttle, telescopes yet to orbit, and missions yet to fly?' Answer: one-half of one percent of each tax dollar. Half a penny. I'd prefer it were more: perhaps two cents on the dollar. Even during the storied Apollo era, peak NASA spending amounted to little more than four cents on the tax dollar.

Weaker currencies abroad mean a strong dollar, and a stronger dollar, together with a weak global environment, is a drag on the U.S. economy. So it's important, as it affects overall levels of production and employment in the U.S. There are many domestic industries doing well in the United States, notwithstanding a strong dollar.

Back in 1960, the paper dollar and the silver dollar both were the same value. They circulated next to each other. Today? The paper dollar has lost 95% of its value, while the silver dollar is worth $34, and produced a 2-3 times rise in real value. Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.