A Quote by Sam Allardyce

Have transfer prices in England surprised me? No. Are the prices over-inflated? Yes. But there is no surprise now.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

The problem is, to have prices fall would work fine if we didn't have all these built in rigidities on downward prices, because then things don't adjust, and that's how we have recessions and depressions, is prices and costs don't adjust together and they get out of whack, and we end up with dislocations.

Stock prices are likely to be among the prices that are relatively vulnerable to purely social movements because there is no accepted theory by which to understand the worth of stocks....investors have no model or at best a very incomplete model of behavior of prices, dividend, or earnings, of speculative assets.

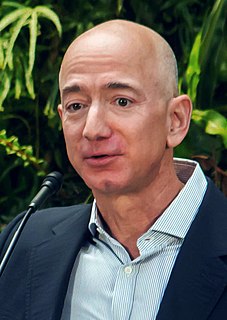

We've done price elasticity studies, and the answer is always that we should raise prices. We don't do that, because we believe -- and we have to take this as an article of faith -- that by keeping our prices very, very low, we earn trust with customers over time, and that that actually does maximize free cash flow over the long term.