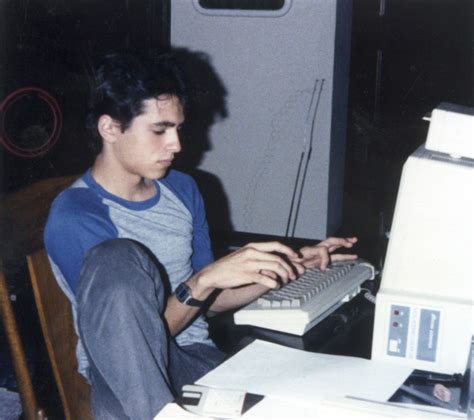

A Quote by Sam Altman

You have to find a small market in which you can get a monopoly and then quickly expand.

Related Quotes

If a company is not a monopoly, then the law assumes market competition can restrain the company's actions. No problem. If a monopoly exists, but the monopoly does not engage in acts designed to destroy competition, then we can assume that it earned and is keeping its monopoly the pro-consumer way: by out-innovating its competitors.

In the whole history of capitalism, no one has been able to establish a coercive monopoly by means of competition in a free market...Every single coercive monopoly that exists or ever has existed...was created and made possible only by an act of government...which granted special privileges (not obtainable in a free market) to a man or a group of men, and forbade all others to enter that particular field.

The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful, it is an important element of the free-market system. The opportunity to charge monopoly prices - at least for a short period - is what attracts 'business acumen' in the first place; it induces risk taking that produces innovation and economic growth.

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.

Near the top of the market, investors are extraordinarily optimistic because they've seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king, speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated. A small rise in interest rates can easily be the catalyst for triggering a bear market at that point.