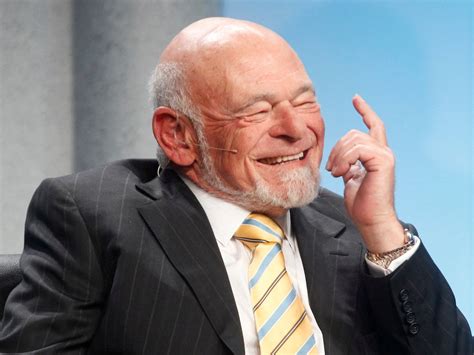

A Quote by Sam Zell

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

Related Quotes

I am specifically concerned about the idea that the legislative process is one that gets characterized the way it is as the 'fiscal cliff.' At the end of the day, the United States is the biggest economy in the world, and the dollar is the reserve currency in the world. I think it behooves us to act in a much more responsible way.

We are privileged that the dollar is the "currency of last resort" and the most important currency in the world. Global commodities are priced in dollars. Central banks in other countries hold great quantities of dollars. The dollar was the safe harbor, the port in the storm during the credit crisis.

The powershift began already several years ago, under the Bush administration, when the dollar became very volatile and started declining. That is when China shifted from having almost 100 percent of its reserves in dollars to 75 percent. Some countries went completely out of the dollar. The dollar, for all intents and purposes, lost its special reserve status and people starting talking about a portfolio, or basket, approach as a store of wealth instead of the dollar.

What there is no dispute about is whether or not China is a currency manipulator. They are a currency manipulator. They actively intervene every single day to keep the value of their currency less than it would be against the dollar than if it floated freely. We think. Even China barely disputes that.

I am concerned about the erraticness of the dollar. The dollar is up, the dollar is down. We print a lot of dollars. The dollar gets devalued. That is really the concern. If people think the gold price up and down is a reflection of something wrong with gold, no - I say it is something wrong with the dollar.

If the Nation can issue a dollar bond it can issue a dollar bill. The element that makes the bond good makes the bill good also. The difference between the bond and the bill is that the bond lets the money broker collect twice the amount of the bond and an additional 20%. Whereas the currency, the honest sort provided by the Constitution pays nobody but those who contribute in some useful way. It is absurd to say our Country can issue bonds and cannot issue currency. Both are promises to pay, but one fattens the usurer and the other helps the People.