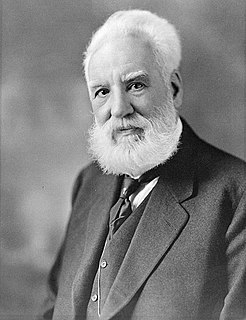

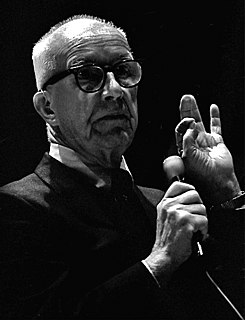

A Quote by Samuel Morse

My price is five dollars for a miniature on ivory, and I have engaged three or four at that price. My price for profiles is one dollar, and everybody is willing to engage me at that price.

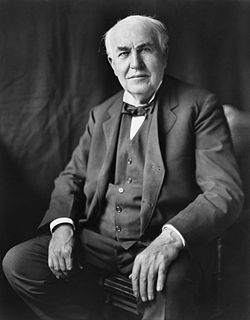

Related Quotes

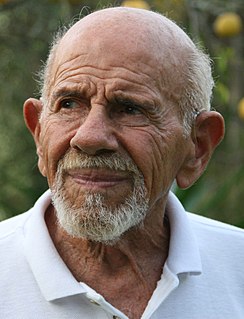

Over time, there's a very close correlation between what happens to the dollar and what happens to the price of oil. When the dollar gets week, the price of oil, which, as you know, and other commodities are denominated in dollars, they go up. We saw it in the '70s, when the dollar was savagely weakened.