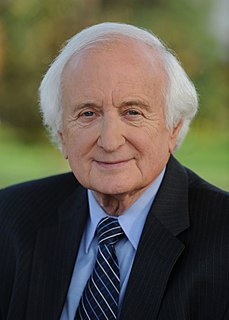

A Quote by Sander Levin

Retirement security is often compared to a three-legged stool supported by Social Security, employer-provided pension funds, and private savings.

Related Quotes

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?