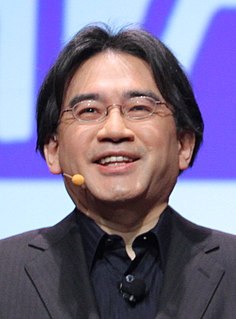

A Quote by Satoru Iwata

If you want to make short-term profits from the stock price, then I am a very bad president. But I don't think I'm so bad for maximizing the long-term value of Nintendo.

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

I want to make it clear, though, that I am not trying to say these are bad drugs. Opioid medications in the short term for severe pain are very effective. The problem is when they are used for long-term chronic pain. No one wants anyone to suffer and be in pain. But realize how addictive these drugs are and get off of them as quickly as you can. So 'Warning: This Drug May Kill You' is really more about educating people about these drugs so that everyone can make their own decision about their pain versus the addictive nature of these drugs.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.