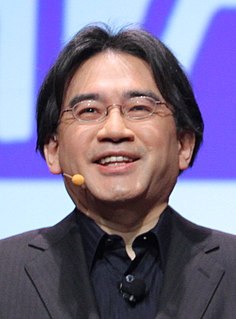

A Quote by Satya Nadella

The enterprise market is never winner-take-all.

Quote Topics

Related Quotes

If you're going to lead a space frontier, it has to be government; it'll never be private enterprise. Because the space frontier is dangerous, and it's expensive, and it has unquantified risks. And under those conditions, you cannot establish a capital-market evaluation of that enterprise. You can't get investors.

The great virtue of free enterprise is that it forces existing businesses to meet the test of the market continuously, to produce products that meet consumer demands at lowest cost, or else be driven from the market. It is a profit-and-loss system. Naturally, existing businesses generally prefer to keep out competitors in other ways. That is why the business community, despite its rhetoric, has so often been a major enemy of truly free enterprise.

One of the symptoms of an absence of innovation is the fact that you lose your jobs. Everyone else catches up with you. They can do what you do better than you or cheaper than you. And in a multinational corporate-free market enterprise, it is the company's obligation to take the factory to a place where they can make it more cheaply.

The market steers the capitalistic economy. It directs each individual's activities into those channels in which he best serves the wants of his fellow-men. The market alone puts the whole social system of private ownership of the means of production and free enterprise in order and provides it with sense and meaning.

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity,' sing the praises of companies with high share turnover... but investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pick pocket of enterprise.