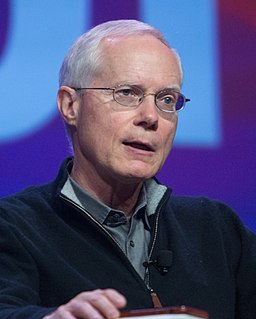

A Quote by Scott Cook

Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with picking individual stocks.

Quote Topics

Related Quotes

I don't invest in the stock market. I did it a long, long time ago when I was really young, and I got involved in all the investigations and all the prosecutions, and I felt it was better if I didn't make individual investments. So I'm invested in funds, but not in individual - not in individual stocks.

Will customers keep supporting the enormous overhead required to sustain ineffectual, unproductive stock picking across an array of thousands of individual funds devoted to every investing 'style' and economic sector or regional subgroup that some marketing idiot can dream up? Not likely. A brutal shakeout is coming and one of its revelations will be that stock picking is a grossly overrated piece of the puzzle, that cost control is what distinguishes a competitive firm from an uncompetitive one.

If the investor doesn't have enough time and skill to investigate individual stocks or enough money to diversify a portfolio, the right thing to do is to invest in exchange-traded funds that give you exposure to asset classes. It does make sense for the individual investor to think in terms of holding individual asset classes.