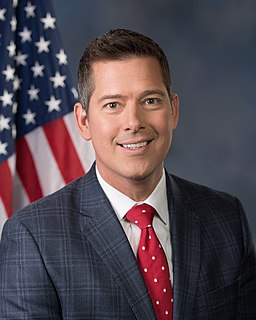

A Quote by Sean Duffy

With 6 kids, I still pay off my student loans. I still pay my mortgage. I drive a used minivan. If you think I'm living high off the hog, I've got one paycheck.

Related Quotes

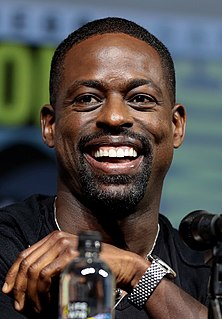

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

If you have to pay about forty to forty-three percent of your income for housing, you also have to pay fifteen percent of your paycheck for the FICA for Social Security wage withholding. You have to pay medical care, you have to pay the banks for your credit card debt, student loans. Then you only have about twenty-five or thirty-five percent, maybe one-third of your salary to buy goods and services. That's all.

I live in a Spanish-style hillside home in Los Angeles, California. I paid $900,000 in 1995. It's perhaps worth about $3m now. Thankfully, I paid off my mortgage before the crash because I could see it coming. I worried that I would be caught having to pay off a very high mortgage for a house I couldn't sell.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.