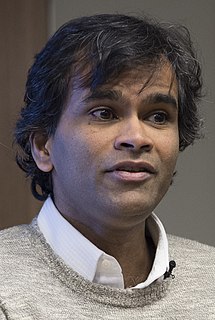

A Quote by Sendhil Mullainathan

We should try to ensure that everyone has a fair opportunity to find a great life. It's a quest that will require political will and ingenious policies. President Obama's proposed expansion of the earned-income tax credit goes in this direction, but we need more.

Related Quotes

Raising the minimum wage and lowering the barriers to union organization would carry a trade-off - higher unemployment. A better idea is to have the government subsidize low-wage employment. The earned-income tax credit for low-income workers - which has been the object of proposed cuts by both President Clinton and congressional Republicans - has been a positive step in this direction.

Sometimes I wonder how much of these debates have to do with the desire, the legitimate desire, for that history to be recognized. Because there is a psychic power to the recognition that is not satisfied with a universal program, it's not satisfied by the Affordable Care Act, or an expansion of Pell grants, or an expansion of the earned-income tax credit.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

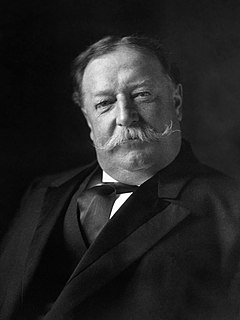

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.