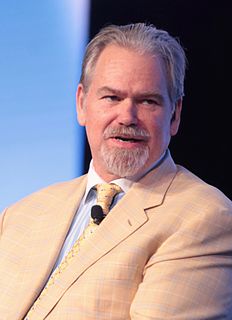

A Quote by Sergio Ermotti

We have a very competitive and profitable investment bank and strong asset management capabilities. We want to continue to build on all those businesses organically.

Related Quotes

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

JPMorgan was already, for the most part. Our businesses at JPMorgan share the same cash-management systems. The commercial bank, the private bank, the retail bank, they all use the branches. The cash-management system moves the money around the world - for global corporations, and for you, the consumer, too.

In investment management today, everybody wants not only to win, but to have a yearly outcome path that never diverges very much from a standard path except on the upside. Well, that is a very artificial, crazy construct. That's the equivalent in investment management to the custom of binding the feet of Chinese women

I'm delighted to be joining INVESCO, an organization that has been growing both in terms of assets under management and the breadth of investment capabilities offered. I see great potential in working with the accomplished investment centers within INVESCO and providing expertise to help develop strategic solutions for our clients.

I think there are probably too many asset management companies in the world, and I think the place to be is either big or small. The area where it is probably more difficult to be is in the middle ground, where you've got that cost of regulation, you've got the cost of buying your own research, you've got all the costs of running an asset management company without the benefits of a big income producing asset.

Their [American banks] big issue will be if they want to deal with the biggest companies, which are doing a lot of business overseas. How they do that is a big question. It's almost impossible to build a global investment bank from scratch. If they want to do that, they probably will have to do an acquisition.

Our government's investments in science, technology and innovation are ensuring that ideas move from the lab to the marketplace faster, creating jobs and opportunities for Canadians. Through our investment in Mitacs Elevate, we are providing training and new career opportunities for talented researchers while ensuring that local businesses such as Vision Extrusions stay competitive and continue to create jobs here in Woodbridge.