A Quote by Sergio Ermotti

As a Swiss-Italian who has always worked for foreign banks, there was clearly an element of pride going back to my roots and working for the biggest bank in my country.

Related Quotes

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

The expansionary operations of the Second Bank of the United States, coupled with its laxity toward insisting on specie payment by the state banks, impelled a further inflationary expansion of state banks on top of the spectacular enlargement of the central bank. Thus, the number of incorporated state banks rose from 232 in 1816 to 338 in 1818.

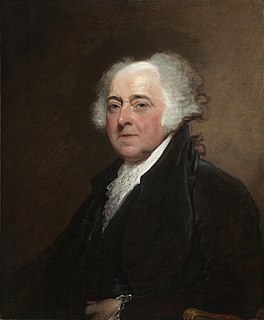

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

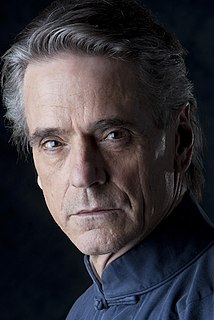

The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks - the most pernicious and insidious of all.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

The federal [bank deposit] insurance scheme has worked up to now simply and solely because there have been very few bank failures. The next time we have a pestilence of them it will come to grief quickly enough, and if the good banks escape ruin with the bad ones it will be only because the taxpayer foots the bill.

In a small Swiss city sits an international organization so obscure and secretive... Control of the institution, the Bank for International Settlements, lies with some of the world's most powerful and least visible men: the heads of 32 central banks, officials able to shift billions of dollars and alter the course of economies at the stroke of a pen.