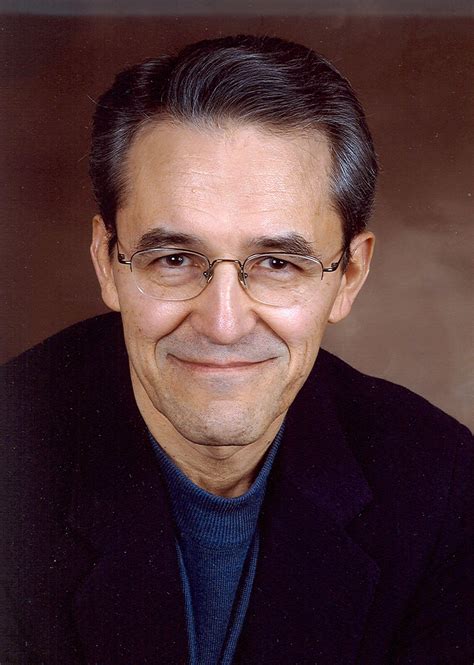

A Quote by Sergio Marchionne

People are very focused on value and preservation of capital. They're a lot less risk-prone than they used to be.

Related Quotes

The hollowing out of the middle class. That's not just about capitalism or the structure of taxation. That is also about the fundamental truth that machines can do a lot of things better than humans used to do. A lot of those people are being pushed down to do less value-adding jobs, so they get paid less money.

In general President Obama's policies have been very, very skewed and very, very extreme. Like on healthcare for example, I don't think that trying to ram healthcare through was a smart idea politically, because he wasted a lot of capital and now he doesn't have any of that same capital with even his own party that he used to have.

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

I used to think that good short-sellers could be trained like long-focused value investors because it should be the same skill set; you’re tearing into the numbers, you’re valuing the businesses, you’re assigning a consolidated value, and hopefully you’re seeing something the market doesn’t see.But now I’ve learned that there’s a big difference between a long-focused value investor and a good short-seller. That difference is psychological and I think it falls into the realm of behavioral finance.