A Quote by Seth Klarman

A simple rule applies: if you don't quickly comprehend what a company is doing, then management probably doesn't either.

Quote Topics

Related Quotes

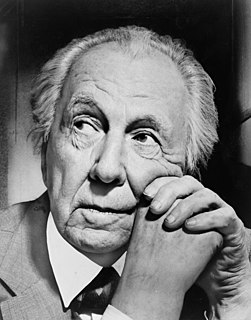

As we live and as we are, Simplicity - with a capital "S" - is difficult to comprehend nowadays. We are no longer truly simple. We no longer live in simple terms or places. Life is a more complex struggle now. It is now valiant to be simple: a courageous thing to even want to be simple. It is a spiritual thing to comprehend what simplicity means.

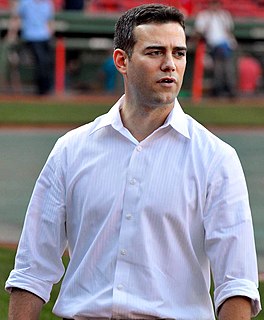

When I was working at the game company, I wasn't just doing graphic design, I was doing the entire product management, so I would do the graphic design, I would create the advertisements, even the catch copies. I would figure out what kind of packaging and design of the packaging, so I was basically doing total product management at that time.

Something as simple as transparency is really scalable because it quickly impacts the culture. And the culture is something everyone feels. If upper management is really transparent with everyone, that has this amplifying effect. Then you tend to attract players who operate that way, on the same wavelength, and coaches and fans.

The challenge is simple: Quitting when you hit the Dip is a bad idea. If the journey you started was worth doing, then quitting when you hit the Dip just wastes the time you’ve already invested. Quit in the Dip often enough and you’ll find yourself becoming a serial quitter, starting many things but accomplishing little. Simple: If you can’t make it through the Dip, don’t start. If you can embrace that simple rule, you’ll be a lot choosier about which journeys you start.

When there is some fear about accounting and growth and the economy, food stocks are a decent place to be, ... This company has been through a bit of a restructuring the last couple of years. Management is doing a great job. The company is improving and people are buying chocolate. So, what a great week to buy it.

As you start the company, you start spending spending spending ahead of revenue but then you come out of it and very quickly you should become a company that spends less than it makes. And what I mean by very quickly, is that window of time should be in that 6 to 8 year time frame. And the reason is because if you build your business model correctly it's almost unavoidable.

I think stupidity in business is really an interesting thing. What winds up happening is a disconnect between your company's strategic management and then your more applied on-the-street management. I guarantee with you that the board of directors of most companies has no idea what the costs of hiring people really is in the HR department.

I think there are probably too many asset management companies in the world, and I think the place to be is either big or small. The area where it is probably more difficult to be is in the middle ground, where you've got that cost of regulation, you've got the cost of buying your own research, you've got all the costs of running an asset management company without the benefits of a big income producing asset.