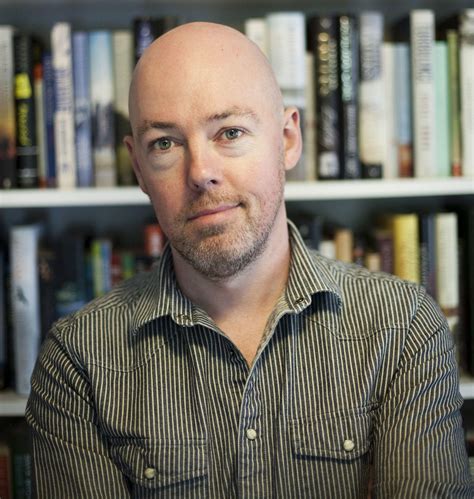

A Quote by Seth Klarman

A value strategy is of little use to the impatient investor since it usually takes time to pay off.

Related Quotes

Ask yourself: Am I an investor, or am I a speculator? An investor is a person who owns business and holds it forever and enjoys the returns that U.S. businesses, and to some extent global businesses, have earned since the beginning of time. Speculation is betting on price. Speculation has no place in the portfolio or the kit of the typical investor.

We take the traditional value investor's process and just flip it around a little bit. The traditional value investor asks 'Is this cheap?' and then 'Why is it cheap?' We start by identifying a reason something might be mispriced, and then if we find a reason why something is likely mispriced, then we make a determination whether it's cheap.

It is crucial to have a strategy in place before problems hit, precisely because no one can accurately predict the future direction of the stock market or economy. Value investing, the strategy of buying stocks at an appreciable discount from the value of the underlying businesses, is one strategy that provides a road map to successfully navigate not only through good times but also through turmoil.

I don't use a Beatmap; I don't use any click track. Any time I count off, it's just in my heart. Sometimes I'll go off the feel of a crowd, like if they way they're bouncing is a little quicker than the song, I might kick up the tempo a little bit. I see where the crowd is at. It's nothing drastic, but all the tempos are from my internal clock.

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

When you play No Limit Hold'em, the ideal strategy is to take minimal risk, do little bluffing, and hope that weaker players call you when you have a strong hand. But that's the perfect world. Sometimes you'll face opponents that play very conservatively and will rarely pay you off when you have the goods.