A Quote by Seth Klarman

In a world in which most investors appear interested in figuring out how to make money every second and chase the idea du jour, there's also something validating about the message that it's okay to do nothing and wait for opportunities to present themselves or to pay off. That's lonely and contrary a lot of the time, but reminding yourself that that's what it takes is quite helpful.

Related Quotes

One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do. Most people – not that I’m better than most people – always have to be playing; they always have to be doing something. They make a big play and say, “Boy, am I smart, I just tripled my money.” Then they rush out and have to do something else with that money. They can’t just sit there and wait for something new to develop

I'd say that that is a challenge, but it also is, again, it's helpful. It's helpful to have the discipline of, okay, I'm doing, I'm doing something that's quite precise over here, working the puppet, and I'm doing something that's very imprecise and creative and unleashed over here, which is the comedy side. And it's kind of nice to allow your brain to be doing those two things at once.

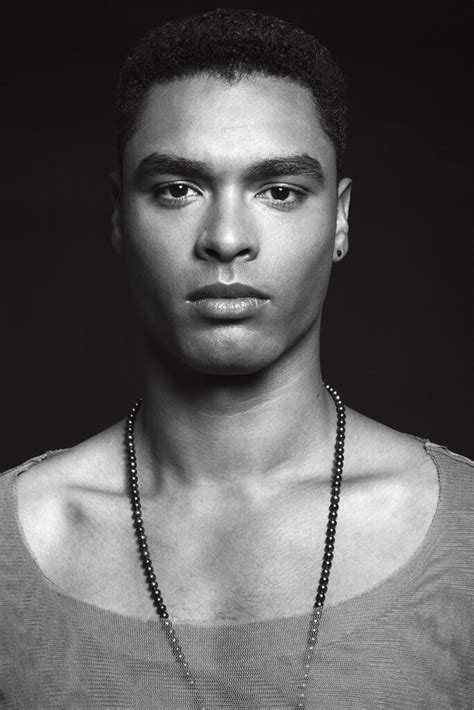

When people ask me about modeling, what it was like, I say, "It was fabulous!" If you can use it in the right way - to travel to meet other people, to learn how to dress, to make some money - I think it's great. But I also think it takes girls. If they don't know how to handle themselves, or if they do it just for a little time and are not successful, then they get terribly depressed about themselves.

A pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street (a community in which quality control is not prized) will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

The goal of a private company is, first, zero to one. Get past the product market fit, figure out whether people actually care about what you're trying to build and someone will pay you money for that. That's the zero to one problem. So scaling, one through N, is figuring out can you do that at scale and how big is the scale. And when people pay you more than what it costs for you to make it, does that equation end up leaving you with money left over, i.e. profits.

If you wanna make money in music, you're better off being on the business end of it a lot of the time. And also as a musician, if you do make money, it means you had to bite and scratch and kick the whole way to not get ripped off, because at every corner, there's somebody there waiting to trip you up and take a bigger chunk.

But in our time women are no longer subject to the will of men. Quite the contrary. They have been given every opportunity to win their independence and if, after all this time, they still have not liberated themselves and thrown off their shackles, we can only arrive at one conclusion: there are no shackles to throw off.

I think there are deep structural things that are wrong in the world. The US is the Western empire of the 19th century regrouping in the 20th, not out of wickedness, but because everybody else in Eurasia was so completely destroyed by the Second World War. Economically, that was quite a useful time for the US, so they ended up in the position of enormous power. And like any great power, they're going to act in their own interests. The problem is due to what the business community wants, which is to make as much money as they can out of what other people do and pay as little as possible for it.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.