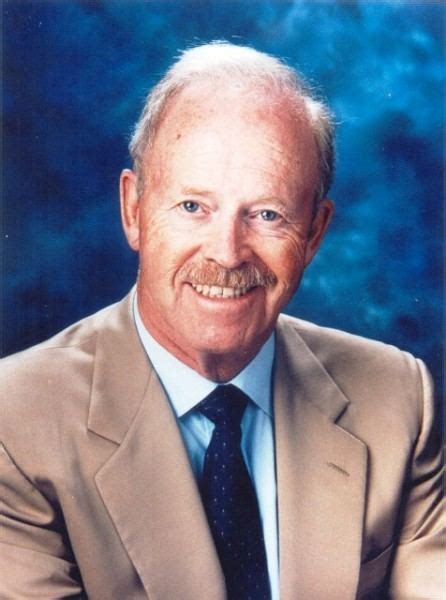

A Quote by Seth Klarman

When managers are afraid of redemptions, they get liquid. We all saw how many managers went from leveraged long in 2007 to huge net cash in 2008, when the right thing to do in terms of value would have been to do the opposite.

Related Quotes

As a result of overdiversification, their (active managers) returns get watered down. Diversification covers up ignorance. Active managers haven't done enough research into any of their companies. If managers have 200 positions, do you think they know what's going on at any one of those companies at this moment?