A Quote by Seth Klarman

Warren Buffett once wrote that value investing is like an inoculation--it either takes or it doesn't--and when you explain to somebody what it is and how it works and why it works and show them the returns, either they get it or they don't.

Related Quotes

In any case, once you're dealing on a nonverbal level, ambiguity is unavoidable. But it's the ambiguity of all art, of a fine piece of music or a painting - you don't need written instructions by the composer or painter accompanying such works to 'explain' them. “Explaining” them contributes nothing but a superficial 'cultural' value which has no value except for critics and teachers who have to earn a living.

If Warren Buffett could change his mind about investing in airlines, Mohnish Pabrai could change his mind about investing in autos. Pabrai, who has modeled his investment career and fee structure after Buffett's original partnership, counts General Motors, Fiat Chrysler, and Ferrari in his highly concentrated portfolio.

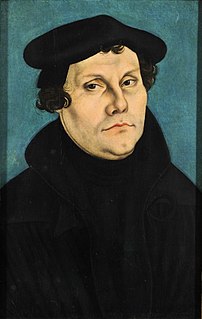

O, this faith is a living, busy, active, powerful thing! It is impossible that it should not be ceaselessly doing that which is good. It does not even ask whether good works should be done; but before the question can be asked, it has done them, and it is constantly engaged in doing them. But he who does not do such works, is a man without faith. He gropes and casts about him to find faith and good works, not knowing what either of them is, and yet prattles and idly multiplies words about faith and good works.

Use them with care, and use them with respect as to the transformations they can achieve, and you have an extraordinary research tool. Go banging about with a psychedelic drug for a Saturday night turn-on, and you can get into a really bad place, psychologically. Know what you're using, decide just why you're using it, and you can have a rich experience. They're not addictive, and they're certainly not escapist, either, but they're exceptionally valuable tools for understanding the human mind, and how it works.